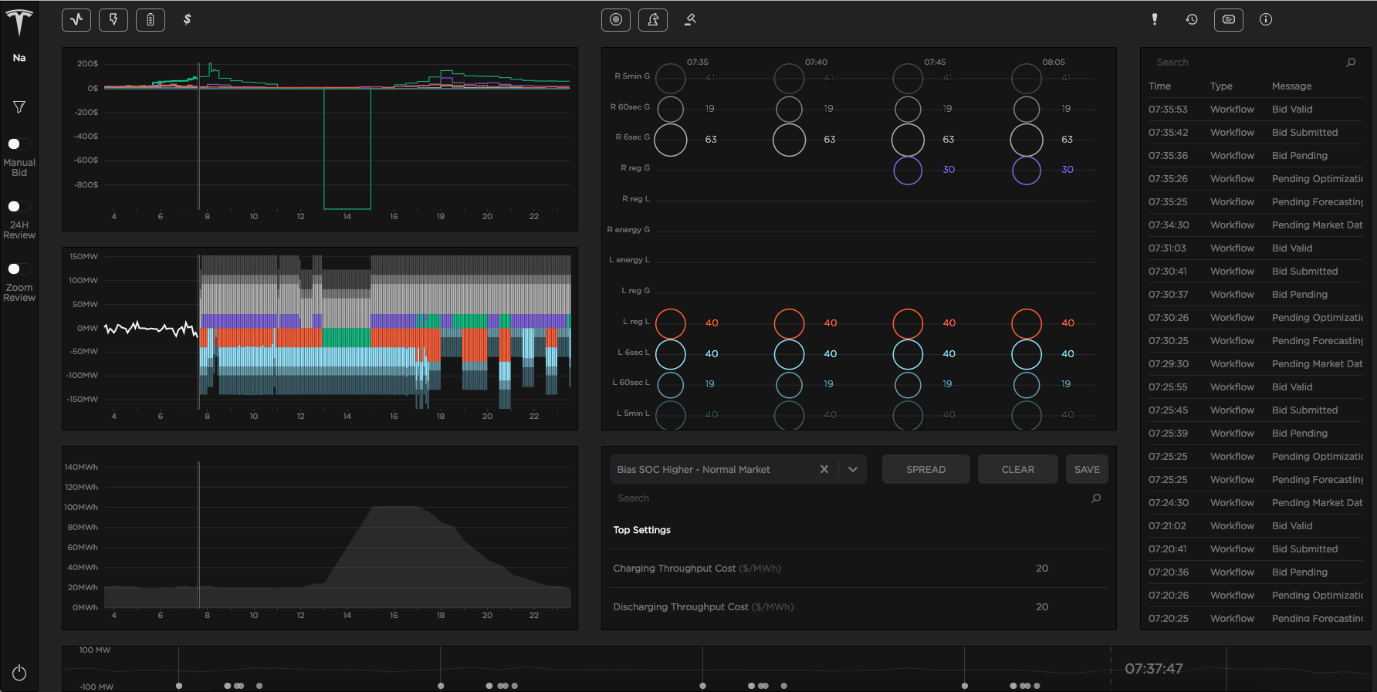

Autobidder provides independent power producers, utilities and capital partners the ability to autonomously monetize battery assets. Autobidder is a real-time trading and control platform that provides value-based asset management and portfolio optimization, enabling owners and operators to configure operational strategies that maximize revenue according to their business objectives and risk preferences. Autobidder is part of Autonomous Control, Tesla's suite of optimization software solutions.

Autobidder is succesfully operating at Hornsdale Power Reserve (HPR) in South Australia, and through market bidding, has added competition to drive down energy prices.

Batteries are highly flexible assets, but they require smart strategies and software to realize their full value. Autobidder allows owners to realize this value by handling the complex co-optimization required to successfully stack multiple value streams simultaneously, including:

- Wholesale markets, including energy, ancillary services and capacity

- Transmission & Distribution-level grid services

- Renewable firming and shaping

- Bilateral contractual arrangements

- Other portfolio needs

In wholesale markets, Autobidder includes participation in the following, where regionally applicable:

- Day-ahead markets

- Real-time markets

- Continuous markets

Autobidder has hundreds of megawatt-hours of assets under management that have supplied gigawatt-hours of grid services globally. Autobidder operates at every scale: from aggregations of behind-the-meter residential systems to 100MW utility-scale installations. With seamless integration between hardware and software, Autobidder can be trusted to capture revenues immediately after project energization and 24/7 in dynamic environments.

Autobidder is hosted on Tesla’s highly reliable and secure cloud infrastructure that is engineered to perform large-scale complex computation and is capable of interfacing with market operators, network providers and customer networks via secure web APIs.

Tesla’s team of experienced machine learning engineers, optimization engineers and market trading experts have created a library of sophisticated algorithms that drive the complex optimal dispatch behavior behind Tesla’s batteries.

The algorithms are based on numerous mathematical techniques including classical statistics, machine learning and numerical optimization. The library includes the functionality to perform:

- Price forecasting

- Load forecasting

- Generation forecasting

- Dispatch optimization

- Smart bidding

Autobidder’s algorithms are adaptable to new markets and services, and continuously improve through experiential data to maintain high financial performance in dynamic market environments.

Autobidder was designed to collaborate with and augment the capabilities of human operators. Autobidder continuously executes transactions in the market using a numerical optimization model that is based on the parameters set and adjusted by a human operator, reflecting the preferences of the trading desk.

Asset owners can be assured that energy storage warranties are protected under Autobidder management. Drawing on Tesla’s deep understanding of battery system physics down to the cell level, Autobidder actively determines the cost and benefit of every potential action, inclusive of revenues streams, warranties and maintenance agreements, to maximize net present value of the asset.

Learn More About Autobidder

Contact us to learn more about Autobidder and the full suite of Tesla Energy Software.